Selling in a Downturn - Sometimes the Best Defense is a Good Offense

In case you haven’t noticed, the news hasn’t been particularly positive over the last couple of weeks. It is impossible to miss the barrage of demoralizing headlines: Cash is king. Layoffs. Fundraising is going to be hard. Budgets are on hold. These are all likely realities for the foreseeable future so, do manage costs tightly, as difficult as it may be. However, don’t give up on sales and growth just yet!

As an entrepreneur or a sales leader that is cutting costs, the next question to ask yourself should be: how can I continue selling and possibly become counter-cyclical?

I was in sales for a company that built workflow software solutions for accounting processes during the Financial Crisis of 2008/2009 and learned some valuable lessons. The lessons learned certainly will not be 100% transferable to our current situation but can hopefully provide a framework for thinking about where your best opportunities may reside right now. Without being overly prescriptive, here are some questions to consider, through the lens of your products, about the current macro environment:

Geographic Impact. Are there geographies that will experience less of a downturn?

Sector Analysis. Which industries may be less impacted?

What types of customers could potentially benefit from the current market challenges?

What challenges will they face that are mission critical?

Government Stimulus. Governments are spending a lot of money to keep the economy afloat. Who will be the recipients of that capital?

Business Processes. What will be some of the ‘lessons learned’ at the end of this cycle? E.g. Were people/companies unnecessarily impacted by preventable factors, and how will they start solving those problems?

Back in ‘08/’09, we were able to ‘defend our turf’ and even manage some growth by focusing our sales and marketing efforts on a few areas:

The Canadian market: Canada was less affected by the mortgage crisis that crippled the US economy.

Businesses that had substantial revenues from the government: One of our largest customers was a government contractor and we were able to increase our engagement with them since government budgets were largely unaffected.

Sectors that benefited from the massive government stimulus packages of that era: One such example was the American Recovery and Reinvestment Act [ARRA] which invested some $800 billion into infrastructure projects. Around this time, we were able to secure our largest North American contract to-date with a Fortune 500 civil engineering firm that was set to be the beneficiary of a substantial chunk of ARRA funding.

Regulated industries like utilities: Fortunately, we had a couple of utilities as customers and, due to the way pricing works in the electricity world, they did not experience immediate revenue erosion. To their credit, they invested in our technology to help cut costs in some back office functions in anticipation of future budget cuts.

Don’t get me wrong, we definitely struggled through those years but these adjustments softened the blow. Some of the lost opportunities came back later on, too. One prospect, that I had been working on a very complex proposal with since June of 2006, pulled their budget just before signatures in December 2008. It was painful but we kept in touch and, two years later, they signed a major deal with us - after a sales cycle of nearly four years.

For the time being, Step back and take a critical look at your company as if you were an outsider and control what you can control:

Think creatively.

Test and learn quickly.

Be a valuable partner to your customers.

Qualify your prospects relentlessly.

Ask the hard questions.

Build your pipeline.

Be painfully honest with yourself.

Be flexible.

Be human.

Take some chances.

With some luck, you will come out stronger on the other side!

More News & Insights

Differential goes on the record with Lizzy Kolar, the co-founder and CEO of Scope Zero. Scope Zero's mission is to reduce annual utility bills and fuel expenses by $300 billion, the environmental equivalent of removing 125M cars from the road.

Differential goes on the record with Moshe Hecht, an award-winning philanthropic futurist and innovator, reshaping the world of giving through technology and data solutions. The founder and CEO of Hatch, he is a dedicated philanthropist and has been published in Forbes, Guidestar, and Nonprofit Pro.

The WorkplaceTech Spotlight host Hadeel Al-Tashi sits down with Lizzy Kolar, Co-Founder and CEO of Scope Zero to dive into how Scope Zero's Carbon Savings Account (CSA) empowers employees to make affordable home technology and transportation upgrades while aligning with corporate sustainability goals. They discuss how the CSA not only supports environmental and financial wellness for employees but also strengthens a company's commitment to sustainability. Don't miss this opportunity to learn how integrating green benefits can drive meaningful impact within your organization.

Hatch AI, a groundbreaking intelligence platform for nonprofits, announced a $3 million raise in seed funding, led by Differential. Read the full press announcement at the link below.

MIT News: Alumni-founded Pienso has developed a user-friendly AI builder so domain experts can build solutions without writing any code.

On the Record with Nate Cavanaugh, CoFounder & Co-CEO of FlowFi.

In 2021, Nate co-founded of FlowFi, a SaaS-enabled marketplace that connects startups and SMBs with finance experts. FlowFi has raised $10M from top VC firms including Blumberg Capital, Differential Ventures, Clocktower Ventures and Precursor Ventures, and generated 7-figures of annual recurring revenue in its first year.

Nate was nominated to the Forbes 30 Under 30 list for Enterprise Technology.

TECHCRUNCH: FlowFi, a startup creating a marketplace of finance experts for entrepreneurs, closed on $9 million in seed funding.

Blumberg Capital led the investment and was joined by a group of investors including Parade Ventures, Differential Ventures, Precursor Ventures, Special Ventures, 14 Peaks Capital and Cooley LLP.

NASDAQ: Nasdaq TradeTalks: 2024 Cybersecurity Budget Outlook with Almog Apirion, Cyolo.

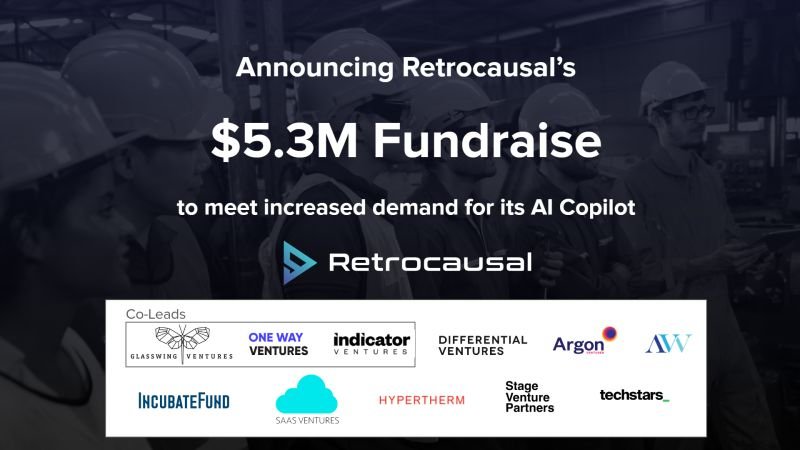

FINSMES: Retrocausal, a Seattle, WA-based platform provider for manufacturing process management, raised $5.3M in funding.

The round was led by Glasswing Ventures, One Way Ventures, and Indicator Ventures, with participation from existing investors Argon Ventures, Differential Ventures, Ascend Vietnam Ventures, Incubate Fund US, SaaS Ventures, Hypertherm Ventures, Stage Venture Partners, and Techstars.

AI and the Future of Work Podcast: Entrepreneurs wonder what it’s like to be a VC. And VCs without an operating background often don’t understand the grit required to turn an idea into a successful business. The best investors have been successful operators first.

Today’s guest is one of those. Nick Adams founded Differential Ventures in 2017 to invest in B2B, data-first seed-stage companies. Since then, Nick and the team have invested in an impressive group of companies including Private AI, Ocrolus, and Agnostiq.

On the Record with Elissa Ross, CoFounder & CEO of Metafold. Elissa Ross is a mathematician and the CEO of Toronto-based startup Metafold 3D. Metafold makes an engineering design platform for additive manufacturing, with an emphasis on supporting engineers using metamaterials, lattices and microstructures at industrial scales. Elissa holds a PhD in discrete geometry (2011), and worked as an industrial geometry consultant for the 8 years prior to cofounding Metafold. Metafold is the result of observations made in the consulting context about the challenges and opportunities of 3D printing.

Nick Adams on PM360: To get a better grasp on what eventual AI regulations could and should look like, PM360 spoke with Nick Adams, Founding Partner at Differential Ventures. In addition to starting the venture capital firm focused on AI/machine learning in 2018, Adams is also a member of the cybersecurity and national security subcommittee for the National Venture Capital Association and recently briefed members of Congress on AI policy and potential regulation.

BETAKIT: Metafold 3D, which wants to make it easier for manufacturers to design and 3D print complex parts, has secured $2.35 million CAD ($1.78 million USD) in seed funding.

Toronto-based Metafold was founded in 2020 by a group of math, geometry, and architecture experts in CEO Elissa Ross, CTO Daniel Hambleton, and COO Tom Reslinski. Born out of Hambleton’s geometry-focused consulting agency, Mesh Consultants, Metafold sells design for additive-manufacturing software to sportswear and biopharmaceutical companies.

Nick Adams on TECHBREW: For all the pixels spilled about the promises of generative AI, it’s starting to feel like we’re telling the same story over and over again. AI is serviceable at document summarization and shows promise in customer service applications. But it generates fictions (the industry prefers the euphemistic and anthropomorphizing term “hallucinates”) and is limited by the data on which it’s trained.

ATLANTA and TEL AVIV, Israel, June 29, 2023 /PRNewswire/ -- Mona, the leading intelligent monitoring platform, unveils a new monitoring solution for GPT-based applications. The free, self-service offering provides businesses with granular visibility into GPT-based products and valuable insights into costs, performance, and quality.

David Magerman on THEINFORMATION: OpenAI’s stated goal is to develop and promote a software system capable of artificial general intelligence. Toward that end, the company has released systems based on large-language models, which can respond to prompts with fluent conversation on many subjects. ChatGPT, Microsoft’s Bing chatbot and other new systems based on OpenAI’s GPT-3 and GPT-4 models are truly incredible and perform far beyond previous attempts at achieving AGI.

BUSINESSWIRE: Morgan Stanley at Work and Carver Edison, a financial technology company, announced today that Shareworks has joined Equity Edge Online® in offering Cashless Participation® to U.S.-based corporate clients. Since the initial launch of Cashless Participation® on Equity Edge Online®, stock plan participants have purchased more than one million shares1 with Cashless Participation®. Now that Shareworks has also launched the tool, a wider cohort of Morgan Stanley at Work corporate clients will have access.

FOX5 WASHINGTON DC: Nick Adams discusses the pros and cons of Artificial intelligence.

PULSE 2.0: Differential Ventures is a seed-stage venture capital fund that was founded by data scientists and entrepreneurs for data-focused entrepreneurs. To learn more about the firm, Pulse 2.0 interviewed Differential Ventures’ managing partner and co-founder Nick Adams.

IoTForAll: Golioth, a leading developer platform for the Industrial Internet of Things (IIoT), announced open access to a library of new reference designs for embedded engineers to accelerate their time to market, the launch of a Select Partner Program for energy and construction developers, and the completion of a $4.6M round of seed funding led by Blackhorn Ventures and Differential Ventures with participation from existing investors, Zetta Venture Partners, MongoDB Ventures and Lorimer Ventures.

VENTURE BEAT: Data privacy provider Private AI, announced the launch of PrivateGPT, a “privacy layer” for large language models (LLMs) such as OpenAI’s ChatGPT. The new tool is designed to automatically redact sensitive information and personally identifiable information (PII) from user prompts.

DIGINOMICA: What can an early-stage investor tell enterprises about the nascent quantum market?

The quantum tipping point – that fabled moment when quantum technologies break through to commercial adoption at scale – has been questioned in a previous diginomica report…

ENTER QUANTUM: Experts agree that commercial quantum computing at scale could be as much as 10 years away, but this hasn’t stopped investors from betting on it turning a profit in the near future. U.S. tech venture capital company Differential Ventures led the recent $6 million seed extension round for quantum software company Agnostiq which it will use to accelerate further development and commercialization of its enterprise-grade quantum and high-performance computing platform Covalent.

In this Q&A, Differential founding partner David Magerman explains why investors are throwing their weight behind commercial quantum now.

On Tuesday, April 25th, 2023, Differential Ventures hosted a webinar on “Banking in Venture Capital & the Tech Industry”. The panel was moderated by David Magerman, Managing Partner of Differential Ventures, and joined by guest speakers Michael Crook (Chief Investment Officer, Mill Creek Capital Advisers), Samir Kaji (CEO & Cofounder, Allocate), and Matt Streisfeld (General Partner, Oak HC/FT).

AICamp: Augment is a 3 month long accelerator program run by Betaworks, aimed at bringing together the most creative pre-seed & seed stage companies building software powered by AI to augment human activity.

Quantum computing startup Agnostiq Inc. said today, April 5, 2023, it has closed on a seed funding round worth $6.1 million to help accelerate the development of its enterprise-grade quantum and high-performance computing platform.

Sand Hill Road Podcast: Nick Adams joined the Sand Hill Road podcast to discuss the way startups can survive a downturn.

UniteAI: There’s no question that machine learning operations (MLOps) is a burgeoning sector. The market is projected to reach $700 million by 2025 – almost four times what it was in 2020.

Still, while technically sound and powerful, these solutions haven’t generated the expected revenue, which has raised concerns about future growth.