Quality of Revenue 'Layer Cake'

By Nick Adams

In a previous post, we discussed ‘Keeping Startup Sales Simple’ which broke down the key inputs of the ‘Sales Velocity’ formula into actionable steps. Next we will tackle Net Revenue Retention [Previous month MRR + upgrades and/or crossells - downgrades - churn] and the departmental considerations for each element of revenue.

We are rapidly approaching the mid-year point which, for many CEOs and CROs, means it is time to take a hard look at what it is going to take to double, triple, or 10x your business during 2022. For many startups that are scaling for the first time, this is a good opportunity to get very familiar with the concept of ‘quality of revenue.’ Understanding revenue from the ground up will help you make more informed strategic decisions across all functional departments and adapt more quickly to changes in your business. Enter the concept of the ‘Revenue Layer Cake.’

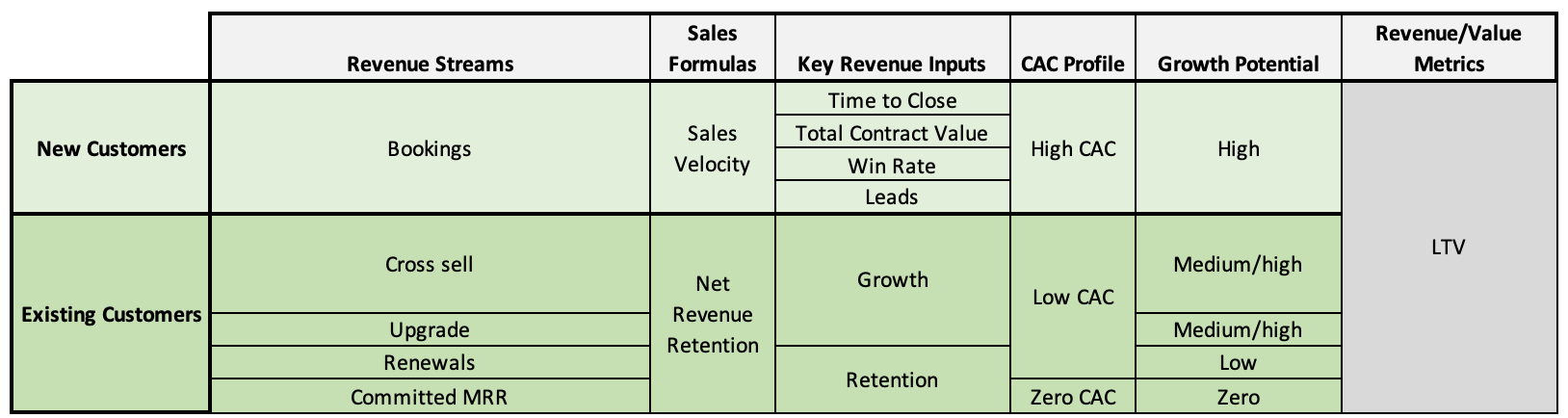

Evaluating sales by predictability, cost of acquisition [CAC], and growth potential is a critical first step to all planning. Each layer of revenue comes with different attributes for costs and growth potential based on whether it is derived from new or existing customers. Establishing that baseline sets the path for assembling the right teams, designing compensation packages, timing your next hires, implementing processes, fundraising strategy, product roadmap, and accurately forecasting the P&L.

The chart below outlines how we think about building the revenue side of the business across new sales and existing customers with the ‘Revenue Streams’ column obviously being the ingredients for the 'layer cake.

Committed MRR [CMRR] provides the foundation with high predictability, no/low CAC, and low growth potential. Life gets a lot easier when Net Revenue Retention is 100% or higher but, in early stage companies, customer churn can be high, and you may not have multiple products to sell into the customer base, so there is typically a higher dependence on new sales. From the CMRR baseline, however, you can work your way up the ladder to calibrate the risk/return profile of the entire revenue stack: lower on the ladder; lower the CAC and growth potential. Higher on the ladder, higher the CAC and growth potential. The final product will be a LTV:CAC ratio and, of course, cash flow.

Why do I bring this up now; with 6 weeks left in Q2??

If you’re being tasked with growing revenue by 2x, 3x, or more next year, then 2022 will have a big target attached to it relative to today and, odds are, your teams are not currently staffed to produce at full capacity next year. Assuming you are a Seed through Series B stage startup, then most of your sales are probably going to come from new customers and most tech sales companies require 3-9 months to onboard and ramp up Account Executives to full capacity.

In our next posts we will discuss implications and action items across the entire organization but, as a starting point, the end of H1 and beginning of H2 is the perfect time to get a baseline assessment of your revenue quality for the rest of the year so you can have an understanding of what levers need to be pulled to reach the new sales targets for the rest of 2021 and 2022.